Digital Asset Management Round-Up, October 2015

Digital Clarity Group’s DAM round-up condenses and consolidates some of the digital asset management industry’s most topical news and happenings from the past month or so. This month’s round-up covers OpenText and SAP’s deepening itegration, Widen’s new analytics capabilities, and a how the DAM industry is poised for huge growth by 2020.

OpenText and hybris take on the Omni-Channel Experience

Enterprise Information Management (EIM) solution provider OpenText has extended the integration of its Digital Asset Management (DAM) solution with SAP® hybris® solutions in the quest to deliver a complete omni-channel experience. OpenText DAM for SAP delivers a single source of digital media for SAP hybris Commerce, SAP hybris Marketing and SAP hybris Customer Experience.

OpenText DAM for SAP will serve as the centralized, secure and accessible repository to manage digital media assets from ideation through to archiving from within the ERP’s platform. This integration enables users to search for media assets, use metadata keyword search, navigate DAM folders, and browse through DAM folder hierarchies all from within the hybris user interface. This release also includes an interface for customization, automated asset version updates, additional rendering services, and an on-demand media delivery service.

This is a big leap forward for the ERP giant in its quest to offer marketers a solution to their omni-channel/any-channel asset management dilemma.

Widen offers analytics with Media Collective 9.0

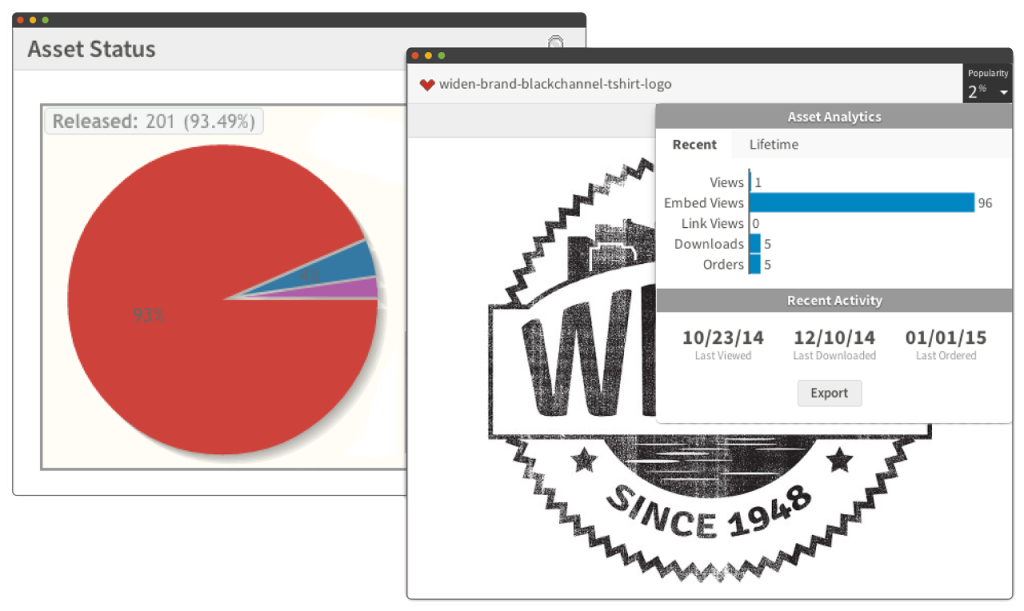

Widen recently announced the release of version 9.0 of their Media Collective DAM solution. While this latest release doesn’t shake any DAM ground, it does offer some interesting improvements and additions.

Most notably is the addition of Insights, a new analytics tool for Media Collective their enterprise DAM solution. According to the press release, Insights analytics tool “combines web and internal DAM analytics to show marketers where digital assets are published, who uses them and how they perform.” This new capability enables the user to track asset activities such as shares, uses, searches, uploads, downloads, etc., both inside and outside of the DAM solution. Access to Insight’s data is delivered via configurable dashboards and charts potenitally making it easier for marketers to identify the strengths, weaknesses and opportunities of their content, and therefore spend their marketing dollars more wisely.

With analytics and attribution being a hot topic among marketers these days, existing Widen customers will be happy with this addition. But while new to Widen, similar functionality is already available in many other mid- and enterprise-level DAM solutions, so its likely not enough in itself to tilt a buyer Widen’s way over similarly outfitted DAM solutions. The overall lack of innovation within the DAM vendor space is a challenge in of itself – without any one vendor pulling ahead with useful, business-problem-solving advancements, there is little pressure within the industry to be truly innovative in their products’ roadmaps. This leaves the door open, as it is today, to vendors offering niche solutions for specific DAM tasks not being adequately addressed by the big guys.

DAM adoption and spend on the rise

Digital Asset Management technology is a hot topic for organizations big and small. With the increasing use and importance of digital content across many facets of an organization, many companies are quickly losing track and control of their digital assets. The need for more control, active management, and tracking of assets has many walking away from using more straightforward file repositories like box and Dropbox, and running towards DAM technology to help stop the sprawl of their images, photos, videos, presentations, audio and other files. The new wave of user friendly, flexible, and affordable DAM tools make metadata capture, search, and collaboration accessible for most marketers, often in a SaaS based offering which further simplifies access and adoption. These are just some of the factors supporting the recent market research by ReportLinker that points to an expected growth from $1.28 Billion in 2014 to $5.21 Billion in 2020 for the global Digital Asset Management market. So while the aforementioned content storage are not going anywhere, they will undoubtedly see, or more likely, continue to see, attrition of corporate customers as they mature in their digital asset management strategies.

Other industry news

Catch up with the key news from around the related industries with Digital Clarity Group’s CMS, e-commerce, and service provider round-ups. All can be found in the Blog section of our website.